Have you recently received an attachment of earnings order?

Don’t panic, this article will inform you on exactly what to do if and when you receive one.

We will also discuss the importance of facing your debts head-on.

Continue reading to find out more.

Table of Content

- 1 What is an attachment of earnings order?

- 2 What happens when I get an attachment of earnings order?

- 3 What happens if I get an attachment of earnings order from council tax arrears or magistrates fine?

- 4 Debt Solutions

- 5 Can you stop an attachment of earnings order?

- 6 How would an attachment of earnings orders affect my debt solution?

- 7 CCJs and attachment of earnings orders

- 8 Child maintenance arrears

- 9 Summary

- 10 The Journey of Debt

What is an attachment of earnings order?

An attachment of earnings is where employee wages are paid directly to repay debts.

A court officer will look at the information given on the defendant’s statement of means and decide how much the defendant can afford to pay. The officer will take into account how much the defendant needs to live on for food, rent or mortgage and essentials and to pay regular bills, such as electricity. This is called the ‘protected earnings rate’. If the defendant earns more than the protected earnings rate, an order will be made. The order will be sent to the defendant’s employer saying how much to take and when to take it.

The AEO order instructs your employer to divert money earned through employment directly from your wages to pay back a debt.

The employer sends the wages to the court who summoned the attachment of earnings and forwards the money to the creditor.

Find Out The Best Debt Solution Bespoke To Your Financial Situation

30 Second Debt Assessment QuizSome people get confused between an attachment of earnings and a direct earnings attachment. A DEA (direct earnings attachment) can be made without you having to attend court when you’ve had the benefit or tax credits overpayments. Read our full guide on the direct earning attachments.

What happens when I get an attachment of earnings order?

It is important you do not ignore a letter from the county court that a creditor has applied for an attachment of earnings order.

You need to do the following to the attachment of earnings order:

- Your county court letter will include an N56 form which is known as the ‘statement of means’

- Complete the N56 form and return with a copy of your most recent wage slip

- If you ignore the court’s correspondence you could be prosecuted

- You can also apply to the court at a later date to suspend the attachment of earnings

An attachment of earnings can only be ordered by the court if you’re employed by someone else, you’re taxed on a ‘pay as you earn (PAYE) basis or receiving an occupational pension.

What happens if I get an attachment of earnings order from council tax arrears or magistrates fine?

If you do get an attachment of earnings order because of either of these two reasons, the order will be set at a fixed percentage that fits your income.

You will also not have to complete a statement of means form, which is giving details of how much money you earn or have saved.

This is because your income will already be on your file.

How much will I pay?

The amount that is taken is set by the court.

They will set a protected minimum amount that fits the amount you get paid each month, which is called the protected earnings rate.

The attachment will only be taken from any earnings above this amount.

The creditor won’t be able to get an attachment order if your overall take-home pay is consistently lower than the protected earnings rate.

You must also inform your creditor as soon as possible if you stop working or change jobs.

Do Not Speak to Debt Solicitors Until You Know About This?

Find Out MoreDebt Solutions

When analysing your credit report and current debtors it is advised to understand all the debt solutions available to you.

Here are all the UK debt solutions available to you depending on where you are based in the UK:

- Best DAS Companies

- Best Full and Final Companies

- Best IVA Companies in Manchester

- Best IVA Companies UK

- Best Sequestration Companies

- Best Trust Deed Companies

- Debt Consolidation Companies

- Debt Relief Order Companies

- DMP Companies

Can you stop an attachment of earnings order?

You can request for an order to be suspended by ticking a box on the N56 form that comes with the order and you must give a reason why.

If the court does accept your request, it will be on the condition that you make the agreed payments.

Once it has been agreed you won’t have to pay directly to the court and just go straight to your creditors.

What happens when the order is suspended?

No further payments will be taken out of your wages unless you fail to keep up with the agreed plan.

Your employer will also not be informed.

How would an attachment of earnings orders affect my debt solution?

If you are on a debt management plan but also happen to have an attachment of earnings order attached to your wages, you would need to get in touch with your DMP provider to seek debt advice.

If you have an attachment of earnings it is more than likely to mean you have less disposable income.

This means that your DMP provider will more than likely need to review your budget to make sure that your monthly payment is still realistic for you.

If your debt was originally included in an IVA your creditor should not try to get an attachment order and you should contact your IVA supervisor.

This is so that they can discuss your options, and may be able to reduce your monthly payments if your creditors agree to do so.

CCJs and attachment of earnings orders

If there is a county court judgment against you and you haven’t paid the amount of money issued, this could result in the creditor applying for an attachment of earnings.

If you continue to ignore it, it could lead to prosecution or court order.

Child maintenance arrears

Child maintenance debt can be taken straight out of your wages with a deduction from earnings order.

There will be a protected minimum amount of income that you will have to get every month for the attachment to be taken.

Summary

Overall, if you get issued an attachment of earnings order it’s important to address it straight away otherwise you can be taken to court if you ignore it for long enough.

The amount you pay will be decided by the court, based upon your wages which will be one monthly payment.

Did You Know You Can Write Off Up To 85% Of Your Debts?

Do I Qualify?You can request to stop an attachment order if you come up with a payment plan with your creditors but it will not always be agreed upon.

If the order is suspended no further money will be taken out of your wages, unless you don’t follow the payment plan set up by your creditors.

However, an attachment of earnings order can be very easily avoided if you seek debt advice from a professional debt advisor if you are struggling to keep on top of your debts.

The Journey of Debt

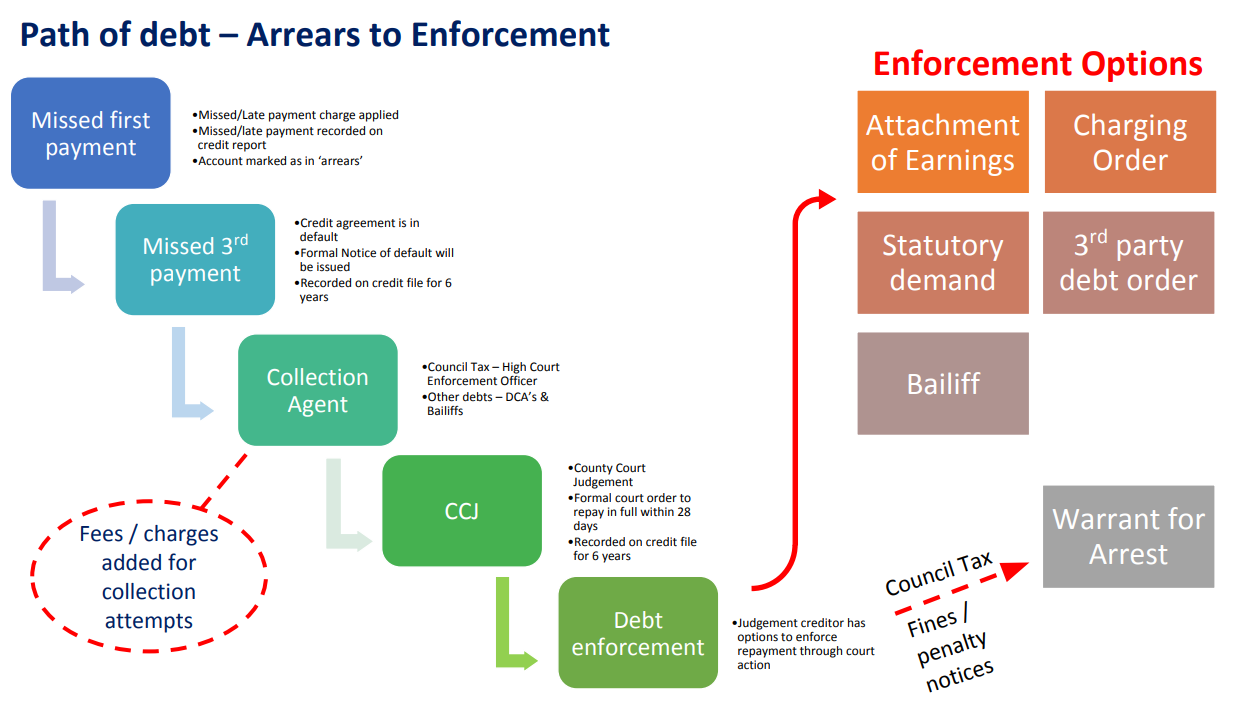

Here is the path of debt – from arrears to enforcement.

- Missed First Payment – Marked as in ‘arrears’

- Missed 3rd Payment – Formal Notice of Default

- Collection Agent

- CCJ – County Court Judgement

- Debt Enforcement – Attachment of Earnings

- Debt Enforcement – Charging Order

- Debt Enforcement – Statutory Demand

- Debt Enforcement – Warrant for Arrest

- Debt Enforcement – 3rd Party Debt Order

- Debt Enforcement – Bailiff