A statutory demand is a written warning issued by a creditor to a debtor.

The statutory demand written letter signals that the creditor will begin taking action to prove the debtor insolvent unless the debt is repaid or an agreed arrangement is made to repay in instalments.

If a creditor wants to make you bankrupt, they must follow a specific set of steps that adhere to insolvency rules. Typically, this will begin with the issuance of a statutory demand, which is a warning letter regarding your debt.

It is critical that you don’t overlook any of the legal requirements, especially any directly included in the insolvency act. If you do, your creditor may file a bankruptcy petition against you.

Interested In Finding Out More About The Debt Solutions Available?

Find Out MoreIn this article, we will learn about the creditor petitions, genuine grounds to set aside the statutory demand, along with some great debt advice. We will also talk about the possible court feed you have to pay, the payment options you can realistically afford, and how to fill up the correct form you may need.

Table of Content

- 1 What is a Statutory Demand?

- 2 What happens after a Statutory Demand has been issued?

- 3 How do I reply to a Statutory Demand?

- 4 How can you dispute a Statutory Demand?

- 5 When are Statutory Demands set aside?

- 6 What happens if I can’t set aside the Statutory Demand?

- 7 What can I do if court actions have already been taken?

- 8 Risks of Ignoring Statutory Demands

- 9 Popular Questions

- 9.1 How long does a statutory demand last?

- 9.2 How do you respond to a statutory demand?

- 9.3 Does a statutory demand have to be served personally?

- 9.4 How long are Statutory Demands Valid?

- 9.5 Does a Statutory Demand affect your credit rating?

- 9.6 Who can serve a Statutory Demand?

- 9.7 Can you amend a Statutory Demand?

- 10 Summary

- 11 Debt Solutions For Statutory Demands

- 12 The Journey of Debt

What is a Statutory Demand?

A statutory demand is a document that a creditor may give you if they intend to file a bankruptcy order against you. Insolvency legislation specifies the structure of the demand and how the creditor must serve it. The statutory demand, on the other hand, is not a court document; the creditor issues it.

A statutory demand is an order to repay what is owed. It is often the final action before a Bankruptcy petition is issued. If the debt isn’t repaid or an agreement is made to repay within 21 days of a statutory demand being issued, creditors can start bankruptcy proceedings against any individuals who owe them £5,000 or more Creditors have 4 months to apply to bankrupt the debtor.

A statutory demand is to determine whether you can afford to pay a debt. If you can’t demonstrate that you can pay the amount, the creditor will use the statutory demand and your answer as proof that you can’t pay your debts if they file bankruptcy petitions against you.

The 18 or 21-day period begins on the date you were served with the demand. When a document is served, it indicates that it was sent correctly. A statutory demand should be served on you directly by the creditor.

If this is not practicable, you may receive the statutory demand by first-class mail or through your letterbox. The statutory demand may be announced in the press in specific restricted circumstances, as the winding-up petition that may start the unravelling of a company.

Statutory demands may be issued to either individuals or companies to other individuals or companies.

One example of an individual filing a statutory demand against a company is when a company director has a statutory demand served to the limited company they are working in. The company director filed the statutory demand because the company owes them money. This is a genuine dispute that will be settled in court and may involve a liquidated sum because of breaches in their contract.

What happens after a Statutory Demand has been issued?

If the Statutory Demand remains ignored and unaddressed, a winding-up petition is likely to be filed.

Should the petition be supported by a court action, your firm would most likely be forced to liquidate. This may be the time to connect with expert solicitors.

If you don’t act quickly to respond to the demand for payment, the actions that follow might lead to the liquidation of your company. In the great majority of situations, a Statutory Demand serves as a prelude to more serious legal action against the delinquent business.

How do I reply to a Statutory Demand?

If you get a statutory demand, you have numerous alternatives to consider. The main thing to remember is not to overlook the problem because it is a formal demand. Ignoring the statutory demand can make matters worse and you can lose all you have worked so hard for.

Here are the possible ways you can reply to a Statutory Demand:

Complying with the Statutory Demand

If you agree to the amount you are supposed to owe and the terms of the statutory demand are correct, the easiest thing to do is to comply with your creditors’ desires – if you can. This can take shape in different forms, such as paying off your debt in whole or working out a payment plan with them to pay what you owe in instalments.

Here are the other ways you can comply with a Statutory Demand.

-

- Pay the debt in full. The simplest method to deal with a statutory demand is to pay the amount if you acknowledge that you owe the obligation and can afford it.

- Pay the debt in instalments. Your creditor could accept your offer to settle your debt in instalments. They could like it since they’ll get more money this way than if you went bankrupt. It may provide you with a cost-effective solution to your debt problems.

- Offer your properties as security against the debt. If you own your house or other property, you may be able to provide creditor security against your debt. When you sell your house in the future, the money will be used to pay down your debt. A voluntary charge is what it’s called. Before consenting to a voluntary charge on your house, you should always get professional housing counsel.

- Set up an Individual Voluntary Arrangement. You might request an individual voluntary arrangement (IVA) as an alternative to bankruptcy if you have valuable assets or a regular income that could be used to pay your creditors. An IVA is a legally enforceable agreement that requires you to pay your creditors over a certain period of time. It can be costly to set up, but it may be a better option than bankruptcy for you.

- Appealing to your creditor to write off the debt. If you have no income or valuable possessions and no other method to pay your debts, you should inform the creditor. You might request that your debt be forgiven. When they realize they have nothing to gain by pursuing you or attempting to bankrupt you (which they would have to pay for), they may decide not to pursue you anymore.

Applying for the Statutory Demand to be Cancelled

If you feel the statutory demand is improper, you can ask for it to be annulled or “put aside” in court. To do so, you’ll need to fill out two forms, one of which will explain why you feel the payment request for the statutory demands is incorrect.

Whichever way you choose to, it is best to keep in mind that you also have additional expenses to consider, like certain debtors’ legal costs. It may be a good idea to work with an insolvency practitioner to give you advice, which essentially means instructing you with the best steps to take.

How can you dispute a Statutory Demand?

After you receive a statutory demand, if you and the creditor are unable to reach an arrangement or there is a dispute, you can move to the court to have the statutory demands set aside by a set of guidelines. You can be served a statutory demand as soon as your debt is due, with a process server being the more favourable option for personal service.

When you file an application to set aside a statutory demand, the 21-day time limit for responding to the demand is suspended until the court decides whether or not to grant your request.

The statutory demand should specify how and where you should file an application to have it overturned. You should move to the High Court if the creditor who gave you the statutory demand is a government department, and the statutory demand states that the petition will be submitted in the High Court.

Provided you have missed the 18-day deadline to statutory dispute demands issued to you; you may still be able to ask to have the statutory demand set aside if you can show good cause for your delay and the creditor has not yet filed a bankruptcy action against you.

The hearing will be scheduled, and you have to attend. If you fail to appear at the hearing, the court will dismiss your request to have the statutory demand thrown out. If the application is denied, your creditor will be able to file a bankruptcy petition against you right away.

If you need additional time to pay the debt indicated in the statutory demand or seek counsel, you can petition the court to postpone the judgment.

The court is unlikely to approve unless you can demonstrate that you have a strategy in place to pay off the debt fast. For example, if you’re selling property to pay off a debt, you’ll need to prove that you’ve found a buyer and inform them of the estimated sale date.

When are Statutory Demands set aside?

On one or more of the following grounds, you might be able to get the statutory demand overturned.

- You have a claim against the creditor for the amount of the debt OR more.

- The debt is secured by property that is equal to or greater than the debt. An offer to secure the debt does not have to be accepted by your creditor.

- The total debt, or the unsecured portion of the loan, is less than £5,000 in total.

- The debt is being contested, and the court considers there are reasonable grounds for it to be contested. This might happen if the creditor has delayed too long to pursue the debtor if the debt is governed by the Consumer Credit Act 1974 and no documented agreement exists.

- The court is convinced that the demand should be dismissed for other reasons. This might be the case if the debt is subject to a court judgment with instalment payments and you have complied with the instalment order. If you utilize this basis, the court will decide whether or not to accept your application.

- If your debt is secured against your goods or your property, you can also petition to have the demand set aside. If your debt is secured, your creditor can seize the asset that is being used to repay you. To get the demand dismissed, the asset used to secure your debt must be worth at least as much as you owe.

What happens if I can’t set aside the Statutory Demand?

If your application to set aside the statutory demand is denied, or if you are unable to apply to the court (for example, because the time period has expired), the creditor may file a bankruptcy petition against you. They can do this at any time after the statutory demand has been served to you for 21 days.

If a creditor files a bankruptcy petition more than four months after serving the statutory demand, the creditor must explain the reason for the delay to the court. When considering whether or not to declare you bankrupt, the court should take this into account.

You may now have a hearing date if you missed a chance to set aside or otherwise deal with your statutory demand. There is yet a chance to prevent bankruptcy from taking place.

You’ll need to notify the court where your hearing will take place to set aside the demand and also to prove that you did not ignore a statutory demand. The court’s information should be in the letter informing you of the hearing.

You should utilise Bank 6 form. You may fill out the form online, then print it off, date it, sign it, and mail it to the court. You must transmit it to the court and your creditor at least five working days before your hearing. Weekends and holidays are not considered business days.

What can I do if court actions have already been taken?

If your creditor already has a county court judgment against you for the obligation, you won’t be able to get the statutory demands set aside on the grounds that you disagree with the debt. Because the court ruling will be used as ‘evidence’ that you owe the amount, this is necessary.

A creditor may file a court claim for a debt you refuse to acknowledge you owe. If you have filed a defence to the claim, the creditor will have to demonstrate to the court a compelling cause based on other grounds for issuing a statutory demand on a debt that you know you have contested.

If you have other creditors side from the one who has already issued a statutory demand, you can expect to receive other statutory demands, with each of these demands functioning under its own set of specific rules.

Risks of Ignoring Statutory Demands

Statutory demands can lead to the bankruptcy of an individual or the winding up of a UK company.

A Statutory Demand process is one of the key stages of insolvency.

The consequences if you served a Statutory Demand and ignore it can be serious to your credit file.

Here are the risks involved in ignoring Statutory Demands:

- Can cause stress and anxiety or be embarrassing for the recipient to share with family

- A Statutory Demand issued to a business that is ignored after 21 days will allow the creditor to start insolvency proceedings to wind up your company

- An individual who ignores a Statutory Demand is at risk of being ordered bankrupt

- Ignoring the Statutory Demand will incur significant legal costs if you decide to challenge or amend this further down the line at a court hearing

The main advice is to not ignore a Statutory Demand, as time is critical with only 21 days to respond.

Seek professional debt advice on your options which will allow you to make an informed response to your creditor.

Popular Questions

How long does a statutory demand last?

A statutory demand lasts 4 months to petition for your bankruptcy.

If creditors want to use statutory demands for longer than four months it will need permission in UK courts.

It is always recommended to comply with a statutory demand by seeking professional debt advice on your options.

How do you respond to a statutory demand?

You need to reach an agreement with the creditor to pay the debt and agree on terms.

If the minimum payments cannot be agreed there are debt options for individuals like debt management plans or IVA debt solutions.

For company debts, the business debt solutions could be using a Company Voluntary Arrangement or CVL debt option.

Does a statutory demand have to be served personally?

A statutory demand can be sent in the post if it is not possible for it to be served in person.

A statutory demand must be delivered in person by either handing it to the individual concerned or else leaving it at the registered office or with the company director or company secretary.

How long are Statutory Demands Valid?

If you don’t pay a statutory demand or set it aside, the creditor has four months to file a bankruptcy petition against you. A creditor will require the court’s authorization to use a statutory demand that is more than four months old.

Does a Statutory Demand affect your credit rating?

Statutory requests do not appear on your credit report. Your bankruptcy conditions will be recorded on your credit file once they have been validated by the official receiver.

Who can serve a Statutory Demand?

Anybody who is owed money, known as the creditor, can serve a statutory demand. You’ll need the following item:

- A clear invoice that refers to the charge for the outstanding debt;

- The deadline for making a payment;

- The period during which the loan must now be repaid (this is often an offer of 21 days from issue).

Can you amend a Statutory Demand?

If the creditor possesses security in connection to the debt that has been included in the Statutory Demand (as per Insolvency Rule 10.1(9)), but the court determines that the Statutory Demand undervalues the security, the court may compel the creditor to revise the Statutory Demand.

Summary

We discussed that the statutory demand is a written warning sent by a creditor to a debtor. The statutory demand may be served to a company, serving as a precursor for a winding-up petition if the debt is not paid, or to an individual, usually through personal service.

If you have had a statutory demand served to you, you can use the steps and tips detailed in this article to save yourself from unnecessary legal costs. Statutory demands may need court proceedings where the debtor appears in court to appeal their case following a court order.

They can please for the court’s permission to halt bankruptcy proceedings or to intercede with the creditor and set aside the statutory demand. We have also discussed answers to questions like, “How long is the statutory demand valid?”

The statutory demand process is relatively straightforward, especially if you have educated yourself and received good debt advice.

Debt Solutions For Statutory Demands

When analysing your credit report and current debtors it is advised to understand all the debt solutions available to you.

Here are all the UK debt solutions available to you depending on where you are based in the UK:

- Best DAS Companies

- Best Full and Final Companies

- Best IVA Companies in Manchester

- Best IVA Companies UK

- Best Sequestration Companies

- Best Trust Deed Companies

- Debt Consolidation Companies

- Debt Relief Order Companies

- DMP Companies

The Journey of Debt

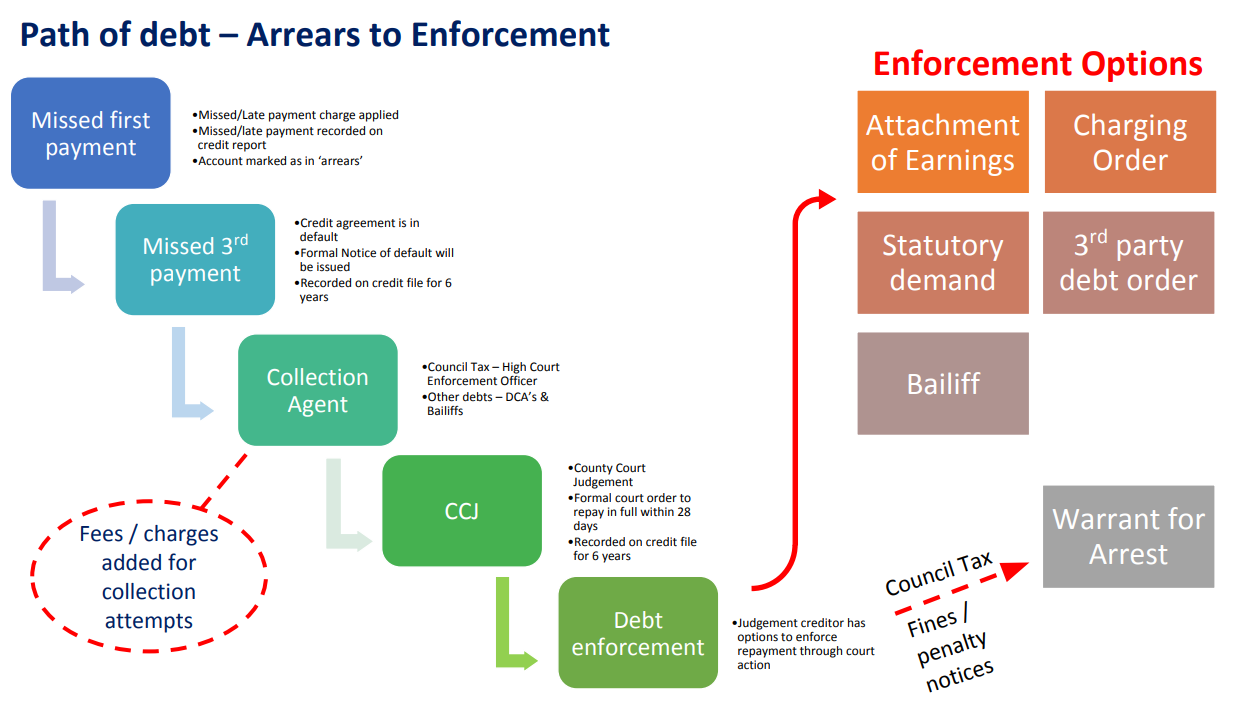

Here is the path of debt – from arrears to enforcement.

- Missed First Payment – Marked as in ‘arrears’

- Missed 3rd Payment – Formal Notice of Default

- Collection Agent

- CCJ – County Court Judgement

- Debt Enforcement – Attachment of Earnings

- Debt Enforcement – Charging Order

- Debt Enforcement – Statutory Demand

- Debt Enforcement – Warrant for Arrest

- Debt Enforcement – 3rd Party Debt Order

- Debt Enforcement – Bailiff