If your creditor has taken out a third-party debt order, you might be wondering what exactly this entails.

A third-party debt order allows your creditor to take the money that is owed to them, directly from whoever is holding the money, such as a bank or building society.

This article covers all you need to know about third-party debt orders and what you can do to prevent them from occurring.

Keep reading to learn what happens when a third-party debt order is made final.

Table of Content

- 1 What is third-party debt order?

- 2 What is the third-party debt order procedure?

- 3 When can your creditor apply for a third-party debt order?

- 4 How much does it cost to apply for a third-party debt order?

- 5 Do you have to pay third-party debt collectors?

- 6 What is a hardship payment order?

- 7 What happens with joint debts and third-party debt orders?

- 8 Can you stop the final third-party debt order from being made?

- 9 FAQs

- 10 Debt Solutions

- 11 Summary

- 12 The Journey of Debt

What is third-party debt order?

A third-party debt order is when a creditor is granted permission by the court to take the money that is owed to them from whoever is holding the money.

The first step to reclaiming outstanding money is to take out a County Court Judgment (CCJ) or a charging order. Then, if the terms of the CCJ are not met by the judgment debtor, the creditor may seek other orders that might help them reclaim their funds.

A third-party debt order is a next step, and it allows creditors to take money directly from a bank or building society that is holding the debtor’s money.

If you are due to receive a large payout, such as redundancy pay, your creditors could even access your money from your employer, insurance company, or solicitors.

What is the third-party debt order procedure?

Firstly, your creditor will check your financial circumstances by applying for an order to obtain information from the court. An order to obtain information will allow your creditor to check your bank account details.

Another piece of information the creditor will seek out is when your payday is. The reason they want this information is so that they can send third-party debt orders on your payday, as payday is when you are likely to have the money available to pay them back.

Interim third-party debt order

The primary step in obtaining a third-party debt order is to apply for an interim order using Form N349. An interim order alerts the banks to freeze your account to ensure no money is moved.

In the interim stage, the creditor will not take any money from your account. The creditor must wait for the final hearing date, in which the judge will confirm what action can be taken to reclaim outstanding money.

Typically, the final third-party order hearing will take place at least 28 days after the interim order has been issued.

To apply for an order, the creditor must have evidence that you have money with the specific bank, or they should have evidence of a previous standing order.

What happens when an interim order has been confirmed?

As soon as the interim third-party debt order has been confirmed, the court will send a letter through to you, your creditor, and your bank or building society.

You will receive your letter seven days after your creditor and bank receive there’s, to ensure you don’t remove any money from your account.

Your bank will then freeze your bank account up to the amount of your debt owed. So, if you owe £5,000, then your account will be frozen up to £5,000. Anything over this amount you can still access.

Once an interim order has been made you won’t be able to access the frozen money which can make aspects of your finance more difficult. For example, without being able to access your funds, it might be harder to pay your bills and mortgage.

For this reason, among many, it is wise to really try and avoid having an interim third-party debt order being taken out against you.

If your creditor thinks that you have the money to pay them and are holding it back, or are due to be paid some money which would cover the debt, they can apply for another court order. This is called a third party debt order. A third party debt order allows your creditor to take the money you owe them directly from whoever has the money. Usually, it is your bank or building society that is holding your money for you. However, if you are due to get a lump sum such as a redundancy settlement, an inheritance or an insurance policy payout, your creditor could get your employer, solicitor or insurance company to pay the money to them instead of you.

Keep reading to find out what you can do if a third-party order leaves you with no access to necessary money.

Final third-party debt orders

Once the interim third-party debt order has been finalised, then a final order hearing is organised to confirm whether your creditor can take your money directly from the bank or not.

If the final order is granted, the creditor is awarded the right to take either:

- The amount that was present in your bank account at the date of the interim order.

- The amount stated on the county court judgment or court order.

It is important to be aware that the interim order only freezes the money that is currently in your account, it will not freeze any money that is paid into your account after such a time.

If your bank or building society account is overdrawn at the date of the interim third-party debt order, then the creditor will not be able to take any money from your account.

Find Out The Best Debt Solution Bespoke To Your Financial Situation

30 Second Debt Assessment QuizWhen can your creditor apply for a third-party debt order?

Your creditor can apply for a third-party debt order if you have failed to meet the requirements and payment of a previous charging order or county court judgment.

Legally, your creditor can submit an application form any time after a charging order has been confirmed. However, they would normally only do so if you have missed payments.

How much does it cost to apply for a third-party debt order?

The county court charges roughly £110 to issue the application for third-party debt orders, plus a £750 fixed fee.

The creditor will pay the application fees, not the debtor. However, any fees that are paid may be added to the total amount that the judgment debtor owes, should the judgment be confirmed.

Do you have to pay third-party debt collectors?

If the debt collector is chasing you for a judgment debt that is definitely yours and you have not paid, then it would be wise to pay them.

Firstly, it is crucial that you ask them for evidence of the following:

- What company or creditor they are chasing payment for.

- Identification to prove they are a validated debt collector and which company they work for.

- Proof that the debt in question is yours.

- Proof of how much debt is outstanding.

You do not have to pay the bailiff straight away and can even request setting up a payment plan.

To learn more about what rights you have when debt collectors show up at your door, read our how to deal with bailiffs article today.

What is a hardship payment order?

If a third-party debt order has resulted in your bank account being frozen, then you might fall into hardship in which you find it extremely difficult to make essential payments, such as bills or mortgage payments.

If you find yourself in this position, then you can apply for a hardship payment order using Form N244 from the court.

Once you have completed Form N244, you will need to take the written evidence to court including the following:

- Copies of your current wage slips.

- Up-to-date bank statements.

- Your mortgage bank account details.

- Your rent book.

- Any other relevant financial documents that show evidence for your current economic situation.

If the third-party order impacts others, such as children, elderly people, or vulnerable individuals, then you should also include evidence to support this.

Do you have to pay to apply for a hardship payment order?

Normally there is a fee to apply for a hardship payment order, however, if your financial circumstances are extreme and the frozen assets mean you can’t make the smallest of payments, then the court may reduce or rule out the fee completely.

If you are suffering hardship then the decision the court makes might release the money held by your judgment creditor to help you pay money towards important bills.

How long does it take for a hardship order to be finalised?

The hardship order will be handled by a judge on the same day that you take your N244 form and evidence into court.

If the hardship order is awarded, then your bank or building society will release a set amount of money to help you make essential payments, such as living expenses.

The confirmation of a hardship order will be sent to your bank or building society account holders and your creditor.

The hardship order may make paying day-to-day living expenses easier for the judgment debtor.

What happens with joint debts and third-party debt orders?

If your bank account is shared with a partner or family member, then your creditor cannot take any money from this account even with a third-party debt order.

However, if the debt in question is joint and shares the same names as the joint bank account, then they can access the funds in the account.

Can you stop the final third-party debt order from being made?

You might have ground to object to the interim third-party debt order if the following applies:

- The debtor’s money is in a joint account with an individual who does not share the debt.

- The debt is significantly small and is arguably not serious enough to warrant third-party claims.

- The third-party order will cause serious hardship to you and other impacted individuals, such as children.

- The debtor’s bank account is overdrawn.

- The money situated in the debtor’s bank account is not their own.

- The debtor’s money is in a building society or credit union account and there would be less than £1 remaining after the money owed is paid.

There may be other significant reasons to avoid having an interim order finalised. If you are unsure about what factors might help prevent a final order, then it may be advisable to speak with a debt advisory service to receive qualified debt advice.

Do Not Speak to Debt Solicitors Until You Know About This?

Find Out MoreFAQs

What is the difference between a third-party debt order and an attachment of earnings order?

An attachment of earnings order allows creditors to take money from your wages, whereas third-party claims allow your judgment creditor to take money directly from your bank or building society accounts.

Both orders are confirmed during a court hearing and will result in the money standing to be repaid to the creditor, however, the method to reclaim sufficient money differs.

Can I move money from my accounts to avoid a third-party debt order taking my money?

There is no law that disallows you from moving money from your accounts before an interim order is finalised.

However, you might not know an interim third-party debt order is being taken out in time to move funds from your accounts.

Is there a fee for freezing your bank account?

There may be a fee charged by your bank for the action of freezing your account.

Your judgment debt may include this fee, as typically the judgment creditor makes this payment first.

The freezing fee may be added to the final third-party debt, making it the debtor’s obligation to pay.

What kind of debt can a third-party order be applied to?

A third-party order can be applied to many kinds of debt, such as:

- Personal loans.

- Credit card loans.

- Outstanding overdrafts.

- Hire purchase agreements.

- Business account debts.

- Savings account debts.

If you have a charging order out for any kind of debt, including those listed above, then you may be faced with a third-party order.

Debt Solutions

When analysing your credit report and current debtors it is advised to understand all the debt solutions available to you.

Here are all the UK debt solutions available to you depending on where you are based in the UK:

- Best DAS Companies

- Best Full and Final Companies

- Best IVA Companies in Manchester

- Best IVA Companies UK

- Best Sequestration Companies

- Best Trust Deed Companies

- Debt Consolidation Companies

- Debt Relief Order Companies

- DMP Companies

Summary

Judgement debtors may face a third-party order if they have failed to meet the terms and payments of a previous CCJ or charging order.

A third-party order will give judgment creditors permission to access their outstanding judgement debt through the debtor’s bank accounts.

You can object to a third-party order if you have limited money, among other reasons, but it is advisable to seek professional debt advice as soon as you fall into arrears.

Did You Know You Can Write Off Up To 85% Of Your Debts?

Do I Qualify?The Journey of Debt

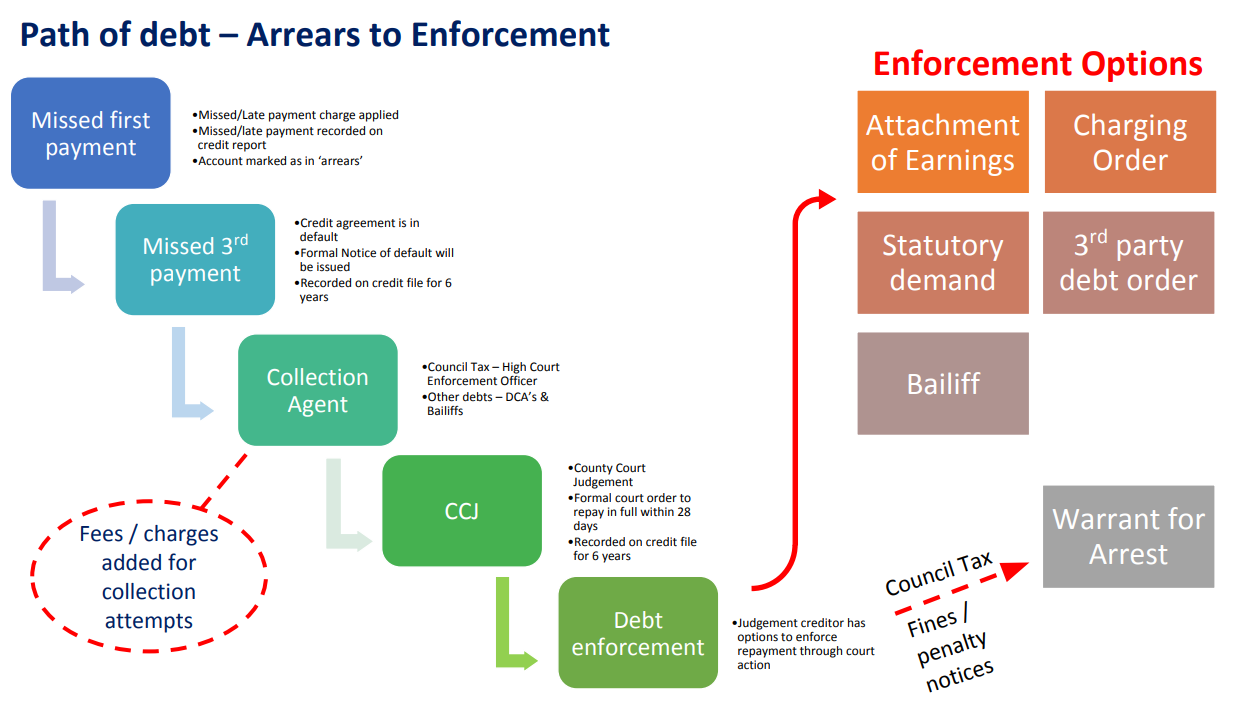

Here is the path of debt – from arrears to enforcement.

- Missed First Payment – Marked as in ‘arrears’

- Missed 3rd Payment – Formal Notice of Default

- Collection Agent

- CCJ – County Court Judgement

- Debt Enforcement – Attachment of Earnings

- Debt Enforcement – Charging Order

- Debt Enforcement – Statutory Demand

- Debt Enforcement – Warrant for Arrest

- Debt Enforcement – 3rd Party Debt Order

- Debt Enforcement – Bailiff