If you have missed a payment and wondering what the repercussions are we run through everything you need to know.

Some UK residents think it won’t matter if you’re a little late paying your creditors, but there are many things you might not be aware of.

If you are struggling with debts or feel it might be a good idea to discuss your situation, we strongly advise speaking to a professional debt advisor for free here.

Get Free No Obligation Advice from A Debt Specialist

Find Out MoreIn the modern era, there are no longer any clear reasons to struggle with debt when there is so much support available from experts!

From simple debt advice to complete debt support, there are plenty of different ways through which you can break free from a potentially harmful debt spiral.

Missing your first payments could be the start of entering persistent debt, where you struggle to pay any fines or higher interest rates on your personal debts.

Debt solutions are fully regulated by the Financial Conduct Authority so if you owe money, it may be time to approach an expert for free debt advice.

Never struggle with arrears when there are helpful debt experts ready and willing to help show you and give the support you need!

Table of Content

- 1 Is Missing a Payment Bad?

- 2 Repercussions Of Missing a Payment

- 3 Does a one-day late payment affect credit score UK?

- 4 What happens when an account is marked as in ‘arrears’?

- 5 What’s the difference between default and arrears?

- 6 How long does missed payments stay on credit report?

- 7 The Journey of Debt

- 8 How can you ensure you never miss a payment?

- 9 Other Debt Solutions

- 10 Summary

- 11 All UK Insolvency Practitioners

Is Missing a Payment Bad?

Failing to make a repayment on time can have serious implications.

It’s easy to think that missing the odd monthly payment here and there isn’t all that much of a problem. But this just isn’t the case.

If you completely miss a monthly payment or are just late then a charge is applied to your credit file.

Missing a payment has repercussions far greater on your credit file than you might think.

Repercussions Of Missing a Payment

Here are the possible repercussions of missed payments.

Fine

When missing a payment you could face an instant ‘missed payment’ fee of about £12.

The fee might not sound like a high fine to pay, but if missed payments happen several times, these charges could soon add up.

A Missed or Late payment charge is applied and the fee is added to your debts.

Risk Losing Your Promotional Offer

Missing a payment can also cost you the 0% interest rate promotional offer you might have with your creditors.

This could mean losing the promotional rate on either purchases or balance transfers, or both.

Promotional offers might be set up on car finance, mortgages, mobile phone contracts, credit cards or loans to entice you into a great deal.

But these promotions are only valid if you remain up to date on repayments in October 2024.

Voiding your promotion with a late payment or missed payment can have large implications in interest rates going up.

Paying a Higher Rate of Interest

If your promotional zero per cent introductory offer or lower interest rate agreement gets withdrawn, you’ll end up paying more in interest.

This will mean your lending interest rates could get a lot more costly.

This creates a debt spiral where individuals find themselves in a state of persistent debt, where they are accruing more interest than they are repaying off their payments.

Missed Payment Recorded on Credit Report

A missed payment or late payment recorded on your credit report is one of the biggest implications.

If a late payment leads to a default notice or County Court Judgment (CCJ) this could have a really serious impact on your score.

Marks can remain on your record for six years.

It is strongly advised to do everything in your power to not get a missed payment or late payment recorded on your credit file.

Affect Ability To Get Credit In The Future

Keeping your credit file clean with no missed payments recorded is the holy grail to being able to get credit.

Your credit score is your financial CV and sets out to creditors how reliable you are with credit.

An overdue payment or default notice may send a warning sign that you’re struggling to manage your finances.

A blemish on your credit file can make it harder to get access to credit, such as credit cards, payday loans and mortgages further down the line.

If your credit file doesn’t stop you from getting accepted for credit in the future, it could still mean you miss out on the most competitive rates available in October 2024.

Does a one-day late payment affect credit score UK?

If your payment is one day late it should not be reflected on your credit report.

A missed payment by 1 day in the UK on credit cards, loans or unsecured lending only really is reported to the credit reporting companies until you have missed a full billing cycle (30 days).

Creditors don’t usually report payments that are less than 30 days late to the credit bureaus. If your payment is 30 or more days late, then the a missed payment can be recorded on your credit report.

The account then is marked as in ‘arrears’.

What happens when an account is marked as in ‘arrears’?

‘In Arrears’ is often the status that precedes a default notice, which will itself be issued by the lender if they believe they have little chance of reclaiming the owed amount.

If you miss payments on a credit account, it is said to be in Arrears by the sum you haven’t paid.

Having an account marked as in ‘arrears’ is the first missed payment recorded on your credit file.

If missed payments continue a Notice of Default will be issued.

What’s the difference between default and arrears?

A default letter is different to an arrears letter and it means the debt is at a later stage in the process.

If you default on your account, it means the lender considers the agreement that you first signed when you borrowed the money to be broken.

A default notice is normally sent when you’ve missed the 3rd payment. Default notices only apply to debts regulated by the Consumer Credit Act. These include credit and store cards, payday loans, personal loans and hire purchases.

Can you receive a default notice after 1 missed payment?

You shouldn’t receive a default notice for missing just one or two payments.

Your creditor is only able to issue a default notice when you’ve missed between three and six months’ worth of payments towards your account.

How long does missed payments stay on credit report?

A missed payment or late payment recorded on your credit report remain on record for six years.

While details of late payments can be viewed on your credit report for six years after they were settled, this dark cloud won’t hang over you forever.

The impact that missed payments, defaults and CCJs have on your rating will diminish as time goes by, as lenders will be most focused on your recent credit history.

By being disciplined about keeping up with repayments going forward, you should see your score steadily improve – eventually making it easier to get access to credit, and at better rates.

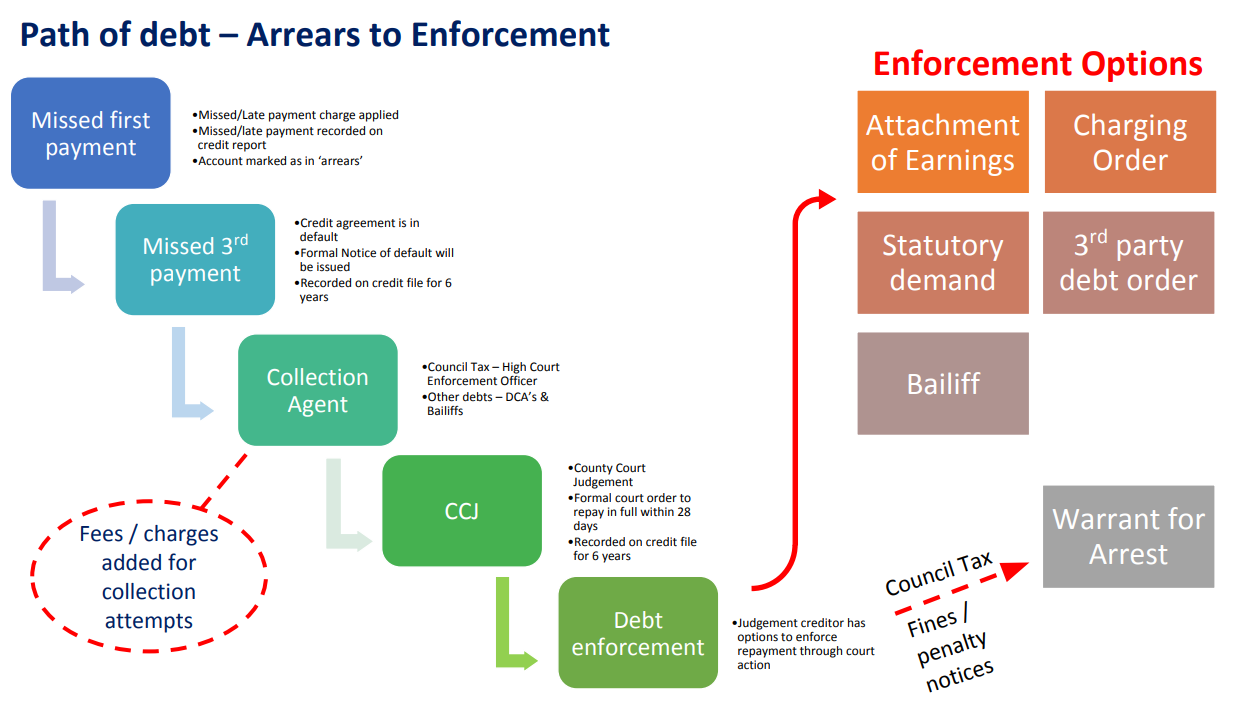

The Journey of Debt

Here is the path of debt – from arrears to enforcement.

- Missed First Payment – Marked as in ‘arrears’

- Missed 3rd Payment – Formal Notice of Default

- Collection Agent

- CCJ – County Court Judgement

- Debt Enforcement – Attachment of Earnings

- Debt Enforcement – Charging Order

- Debt Enforcement – Statutory Demand

- Debt Enforcement – Warrant for Arrest

- Debt Enforcement – 3rd Party Debt Order

- Debt Enforcement – Bailiff

How can you ensure you never miss a payment?

Here are some ways to ensure you never miss a payment to your creditors.

- Only apply for credit you can be sure you can comfortably afford

- Budget carefully to ensure you have enough money to make your repayments each month

- Use calendar reminders to stay on top of your finances

- Set up a direct debit to make sure your monthly repayment goes out automatically. To be on the safe side, arrange this so the money goes out a week in advance of the due date

- Make sure this covers at least the minimum repayment, but aim for more if you can. If you clear your card in full each month, you’ll pay no interest at all

- Have a safety net in place in the form of an emergency fund

- If you are struggling to keep up with your minimum payments, speak to a specialist debt advisor and seek free professional advice

- Don’t bury your head in the sand if you have debt problems. Seek free advice as soon as possible

Other Debt Solutions

When analysing your credit report and current debtors it is advised to understand all the debt solutions available to you.

Here are all the UK debt solutions available to you depending on where you are based in the UK:

- Best DAS Companies

- Best Full and Final Companies

- Best IVA Companies in Manchester

- Best IVA Companies UK

- Best Sequestration Companies

- Best Trust Deed Companies

- Debt Consolidation Companies

- Debt Relief Order Companies

- DMP Companies

Summary

The golden rule of lending is that you must make all payments are on time.

Did You Know You Can Write Off Up To 85% Of Your Debts?

Do I Qualify?All UK Insolvency Practitioners

Here is a full list of Insolvency Practitioners in the UK:

- Abbotts Insolvency Review

- Anchorage Chambers Insolvency Review

- Angel Advance Insolvency Review

- Best CVA Companies

- Best DAS Companies

- Best Full and Final Companies

- Best Insolvency Practitioners

- Best IVA Companies in Manchester

- Best IVA Companies UK

- Best Sequestration Companies

- Best Trust Deed Companies

- Creditfix Insolvency Review

- Debt Champion Insolvency Review

- Debt Consolidation Companies

- Debt Focus Insolvency Review

- Debt Relief Order Companies

- Debtfree4me Insolvency Review

- DMP Companies

- Financial Support Systems Insolvency Review

- Forest King Insolvency Review

- Freeman Jones Insolvency Review

- Gregory Pennington

- Hanover Insolvency Review

- Jarvis Insolvency Review

- Johnson Geddes Insolvency Review

- McCambridge Duffy Insolvency Review

- MoneyPlus Insolvency Review

- PayPlan Insolvency Review

- Re10 Finance Insolvency Review

- Spencer Rowe Insolvency Review

- The Debt Advisor Insolvency Review

- Unity Corporation Insolvency Review

- Vanguard Insolvency Review

- X Debt Insolvency Review

The insolvency service list above gives you plenty of options to choose the best IVA firm in October 2024.